Publications

“Derisking as Worldmaking: Climate Finance and the Politics of Uncertainty,” Review of International Political Economy (March 2025). [PDF]

Abstract: The derisking state has by now emerged as the key aspirational agent of the energy transition. But what is the concept of risk involved in derisking? This article places debates about derisking within a broader politics of uncertainty by turning to John Maynard Keynes’s intersubjective theory of probability in which both market actors and states navigate such uncertainty by shaping conventions and calculative devices that can coordinate expectations. Derisking entails from this perspective not merely a redistribution of risk but rather a more profound transformation of uncertainty into risk, as well as a comprehensive framework for how risk is perceived, articulated, and managed. This allows me to develop an account of financial worldmaking and reframe derisking as a form of hidden, conservative worldmaking based on a demand for calculability and profitability on the part of investors. Building on this critique the article then articulates an alternative model of green worldmaking by a Smart Green State that actively shapes expectations and actively deploys uncertainty. I conclude by reflecting on the limits of technocratic green worldmaking while stressing the need for tools that can discipline carbon capital.

“Expedience and Experimentation: John Maynard Keynes and the Politics of Time”, American Journal of Political Science 69:1 (January 2025), 371-382. [PDF]

Abstract: John Maynard Keynes is often seen as the quintessential thinker of the short run, calling on us to focus our intellectual and material resources on the present. This poses an intriguing puzzle in light of Keynes’s own influential speculations about the future. I use this seeming tension as an opening into Keynes’s politics of time, both as a crucial dimension of his political thought and a contribution to debates about political temporality and intertemporal choice. Keynes’s insistence on radical uncertainty translated into a skepticism toward intertemporal calculus as not only morally objectionable but also at risk of undermining actual future possibilities. Instead of either myopic pre- sentism or calculated futurity, Keynes advocated bold experimentation in the present to open up new possibilities for an uncertain future. This points to the need to grapple with how to align multiple overlapping time horizons while appreciating the performativity of competing conceptions of the future.

Abstract: While money is deeply political, that politics cannot be reduced to a sovereign will or decision. Rather, modern money is a complex hybrid that is both private and public, always economic and political at once. Money and banking are never purely private but they are tethered to the state and its central bank—and banks are fundamentally unlike other companies. But this also means, inversely, that even the state’s capacity to steer money creation is embedded in a capitalist frame of value. Here, Keynes’s understanding of money of account meets Marx’s value theory. To adapt Marx’s quip about historical agency from the Eighteenth Brumaire (Marx 1978: 595): states make money but they do not always do so as they please.

Abstract: In this essay I clarify, extend, and complement several aspects of my conceptual and historical argument in The Currency of Politics. I do so primarily by situating my account more explicitly within debates over European monetary politics, by expanding on my use of history, and by articulating what differentiates my concern with the political theory of money and the politics of depoliticisation from complementary accounts. In doing so I elaborate on the ways in which engagement with the thought of John Maynard Keynes helped to structure my approach. While there are important limits to the politics of money under contemporary capitalism, these limits are not fixed economic ones but are better seen as political limits of monetary politics that nonetheless leave considerable space for articulating alternative demands for more democratic forms of money. This framing allows me to extend my argument in order to address contemporary struggles over credit policy, monetary reform, and climate change in Europe. I thus end with a set of critical reflections on the constitutional status of money in the European project and beyond.

Abstract: This article interrogates the contemporary appeal of crypto-politics and gamified retail finance through the lens of democracy. It introduces the concept of counterfeit democracy to capture how claims to “democratize finance” mobilize democratic language while emptying it of its substantive political meaning. Crypto-political imaginaries promise empowerment through access—access to markets, platforms, and speculative opportunity—while displacing democracy as a practice of collective judgment over an uncertain future. The article traces how this logic emerged from earlier attempts to depoliticize monetary governance and why it continues to resonate under conditions of economic precarity and weakened democratic institutions. By distinguishing between democracy as collective power and gambling as individualized exposure to risk, we show how speculative participation comes to stand in for democratic agency itself. The article concludes that resisting crypto’s appeal requires confronting the hollowing out of democratic economic institutions, not merely condemning speculation.

The Theodicy of Growth: John Rawls, Political Economy, and Reasonable Faith, Modern Intellectual History, Vol 18, Issue 4 (December 2021), pp. 984-1009. [https://doi.org/10.1017/S1479244320000475]

Abstract: Rediscovery of John Rawls's early interest in theology has recently prompted readings of his philosophical project as a secularized response to earlier theological questions. Intellectual historians have meanwhile begun to historicize Rawls's use of contemporary philosophical resources and his engagement with economic theory. In this article I argue that what held together Rawls's evolving interest in postwar political economy and his commitment to philosophy as reconciliation was his understanding of the need for secular theodicy. In placing Rawls in the intellectual context of a postwar political economy of growth as well as in relation to the history of political thought, including his reading of that history, I defend two claims. First, I argue that Rawls's philosophical ambition is best understood as providing a secular reconciliatory theodicy. Second, I suggest that Rawls's theodicy was initially rendered plausible by the economic background conditions of economic growth that were fractured and fragmented just as Rawls's book was published in 1971. This divergence between text and context helps to account for Rawls's peculiar reception and his own subsequent attempt to insist on the applicability of his theory under radically altered circumstances.

Daniel Bell’s Dilemma: Financialization, Families, and their Discontents, Capitalism: A Journal of History and Economics, Vol. 1, Issue 1 (Spring 2020). [https://doi.org/10.1353/cap.2019.0002]

Abstract: According to Daniel Bell’s Cultural Contradictions of Capitalism (1976), during the 1970s advanced post-industrial societies became entangled in a fateful contradiction. The postwar boom and the counter-culture of the 1960s had entrenched a consumerist ethic of immediate gratification and self-realization that undermined the Protestant virtues of frugality and modesty, which Bell – following Max Weber – considered the pillars of capitalism’s historical success. Far from entrenching conservative values, the corporate capitalism of the postwar years had unwittingly produced a hedonistic consumer society. By implication, the patriarchal household had become destabilized as a basic institution of economic discipline. The 1980s seemed to prove Bell spectacularly wrong. Instead of a cultural contradiction between hedonism and discipline, the decade explosively fused the two. But if Bell’s prognosis turned out to be wrong, this was precisely because his diagnosis had been so acute. While failing to envisage what was to come, Bell was extraordinarily prescient about the central political dilemma of advanced capitalism that produced an unexpected politics of depoliticization. Democratic capitalist politics after the boom, Bell concluded, was stuck in a seemingly inescapable dilemma between the essential need for economic intervention and the devastating effect that those very acts of intervention have on political legitimacy. This article reconstructs Bell’s dilemma and places it into conversation with recent feminist histories of neoliberalism and the sexual revolution.

John Locke and the Politics of Monetary Depoliticization, Modern Intellectual History, Volume 17, Issue 1 (March 2020), 1-28. [https://doi.org/10.1017/S1479244318000185]

Abstract: During the Coinage Crisis of 1695, John Locke successfully advocated a full recoinage without devaluation by insisting on silver money’s “intrinsick value.” The Great Recoinage has ever since been seen as a crucial step toward the Financial Revolution and it was long regarded as Locke’s most consequential achievement. This article places Locke’s intervention in the context of the post-revolutionary English state at war and reads his monetary pamphlets as an integral, if largely neglected, part of his political philosophy. Instead of taking Locke’s insistence on “intrinsick value” itself at face value, I argue that it was precisely money’s fragile conventionality that threatened its role as a societal bond of trust. In response to this fragility and corruptibility Locke tied money by fiat to an initially arbitrary but unalterable quantity of metal. While Locke’s argument contributed to the modern naturalization of money, it arose from a paradoxical political act of monetary depoliticization.

Between Justice and Accumulation: Aristotle on Currency and Reciprocity, Political Theory, Volume 47, Issue 3 (June 2019), 363-390. [https://doi.org/10.1177/0090591718802634]

Abstract: For Aristotle, a just political community has to find similarity in difference and foster habits of reciprocity. Conventionally, speech and law have been seen to fulfill this role. This article reconstructs Aristotle’s conception of currency (nomisma) as a political institution of reciprocal justice. By placing Aristotle’s treatment of reciprocity in the context of the ancient politics of money, currency emerges not merely as a medium of economic exchange but also potentially as a bond of civic reciprocity, a measure of justice, and an institution of ethical deliberation. Reconstructing this account of currency (nomisma) in analogy to law (nomos) recovers the hopes Aristotle placed in currency as a necessary institution particular to the polis as a self-governing political community striving for justice. If currency was a foundational institution, it was also always insufficient, likely imperfect, and possibly tragic. Turned into a tool for the accumulation of wealth for its own sake, currency becomes unjust and a serious threat to any political community. Aristotelian currency can fail precisely because it contains an important moment of ethical deliberation. This political significance of currency encourages contemporary political theorists to think of money as a constitutional project that can play an important role in improving reciprocity across society.

The Allure of Dark Times: Max Weber, Politics, and the Crisis of Historicism (with Adam Tooze), History & Theory, Vol. 56, Issue 2 (June 2017), 197-215. [https://doi.org/10.1111/hith.12014]

Abstract: This article argues that realist invocations of Max Weber rely on an unrealistic reading of Weber’s realism. In order to escape the allure of Weber’s dramatic posture of crisis, we place his seminal lecture on “Politics as a Vocation” (1919) in its historical and philosophical context of a revolutionary conjuncture of dramatic proportions, compounded by a broader crisis of historicism. Weber’s rhetoric, we argue, carries with it not only the emotion of crisis but is also the expression of a deeper intellectual impasse. The fatalistic despair of his position had already been detected by some of his closest contemporaries for whom Weber did not appear as a door-opener to a historically situated theory of political action but as a telling and intriguing impasse. Although the disastrous history of interwar Europe seems to confirm Weber’s bleakest predictions, it would be perverse to elevate contingent failure to the level of retrospective vindication.

Book Chapters

“Mephistopheles in the Anthropocene: Keynes’s Faustian Bargain and the Politics of Green Growth” (forthcoming in Marion Fourcade, Greta Krippner, and Sarah Quinn (eds.), Political Economy, Rebooted (Duke University Press).

Abstract: Today, Keynes is once more frequently invoked under the heroic guise of Green Keynesianism. In contrast to this simplistic invocation of him as a savior figure, it is worth recovering the ways in which Keynes grappled with a profound dilemma of capitalism that we confront today in a particularly acute form with a green twist. By re-reading Keynes’s “Economic Possibilities for our Grandchildren” (1930) not as a prediction but an exercise of moral imagination and a work of speculative fiction that explores future possibilities beyond the confines of capitalism, there is much to be learned in shifting from Green Keynesianism to Keynes himself. Doing so allows us to replace the misleading certainties of Keynesianism with Keynes’s own much more ambivalent thought that speaks more productively to the dilemmas of our present. This version of Keynes is at the same time no less troubling, as I explore in this chapter through E.F. Schumacher’s influential critique. Our own impasse mirrors Keynes’s Faustian bargain in a number of curious and haunting ways. To be sure, Keynes’s reasons for imagining a world beyond perpetual growth were primarily ethical rather than ecological. But the analogy is nonetheless striking, not least because of Keynes’s ultimate insistence on the need to indulge the moral distortions of capitalism for just a little longer. The underlying stakes of this Anthropocene version of Keynes’s Faustian bargain have at the same time been further raised. And yet it is far from clear that we can afford to dismiss our Mephistopheles.

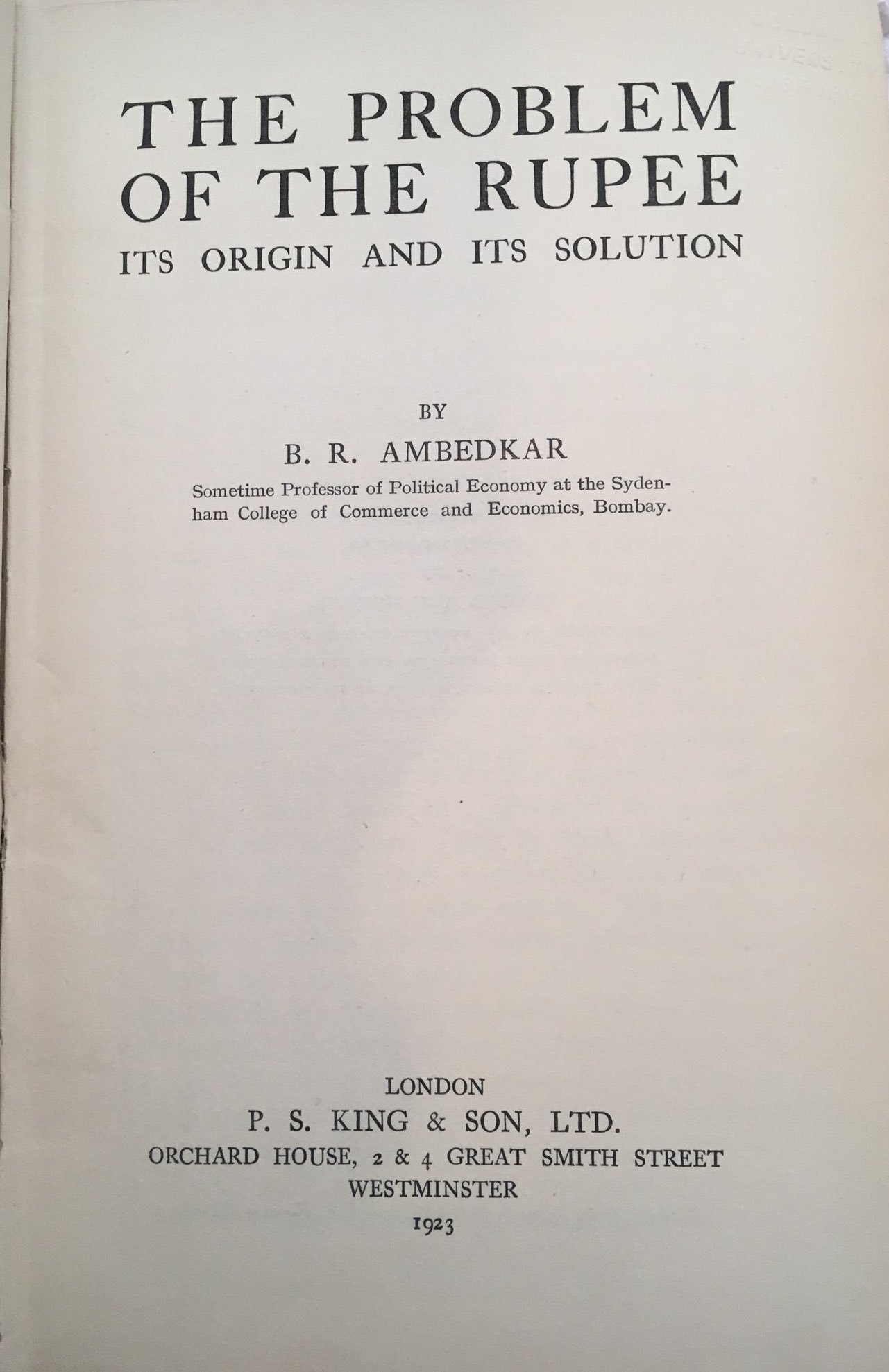

“The Problem of the Rupee,” in The Cambridge Companion to Ambedkar, ed. Anupama Rao and Shailaja Paik (Cambridge University Press, forthcoming).

Often overshadowed by its author’s subsequent just fame in law and politics, The Problem of the Rupee marked Ambedkar as one of the world’s leading authorities on Indian currency and banking during the interwar years who grappled with the colonial politics of monetary hierarchy. This chapter sketches a synoptic exposition and historical interpretation of The Problem of the Rupee by reading it in three related intellectual and historical contexts. First, I follow Ambedkar’s analysis in parsing questions of exchange, inequality, and empire in an explicitly global context. Secondly, I place Ambedkar’s analysis in its immediate historical intellectual context of debates in Indian political economy and British monetary theory, as well as complementing these from the perspective of a more recent literature on money and empire that allows for a re- evaluation of Ambedkar’s path-breaking account. Thirdly, I turn to the ways in which Ambedkar’s interests in castes and constitutions predate The Problem of the Rupee and can be detected in its policy prescriptions, albeit in ways that are not easily recognized. Though seemingly sidestepped or relegated to the far background of the book, questions of class equality and social justice were crucial for Ambedkar’s argument, which culminated in a surprising and paradoxical defense of the gold standard as a potential weapon of the weak.

Related publications:

Stefan Eich, “In Ambedkar’s treatise on rupee, a clear-eyed vision,” The Indian Express (December 10, 2023). (Online version here; print version here)

Book abstract: In Defining the Age, Paul Starr and Julian E. Zelizer bring together a group of distinguished contributors to consider how well Bell’s ideas captured their historical moment and continue to provide profound insights into today’s world. Wide-ranging essays demonstrate how Bell’s writing has informed thinking about subjects such as the history of socialism, the roots of the radical right, the emerging postindustrial society, and the role of the university. The book also examines Bell’s intellectual trajectory and distinctive political stance. Calling himself “a socialist in economics, a liberal in politics, and a conservative in culture,” he resisted being pigeon-holed. Defining the Age features essays from historians Jenny Andersson, David A. Bell, Michael Kazin, and Margaret O’Mara; sociologist Steven Brint; media scholar Fred Turner; and political theorists Jan-Werner Müller and Stefan Eich. While differing in their judgments, they agree on one premise: Bell’s ideas deserve the kind of nuanced and serious attention that they finally receive in this book.

Abstract: Cryptocurrencies are frequently framed as future-oriented, technological innovations that decentralize money and thereby liberate it from the state. This is misleading on several counts. First, electronic currencies cannot leave the politics of money behind even where they aim to disavow it. Instead we can understand their impact as a political attempt to depoliticize money. Secondly, the dramatic price swings of cryptocurrencies challenge their claims to be currencies and place them more persuasively as speculative assets. Thirdly, far from heralding a radical break with the past, electronic currencies serve as a reminder of the still unresolved global politics of money of the 1970s. To support these three interrelated claims I place the rise of cryptocurrencies in the historical context of the international politics of money since the 1970s and the response to the Financial Crisis of 2008.

Abstract: This chapter takes stock of the ways in which debates about Europe’s exterior boundaries intersect with discussions about the nature of European identity. The collapse of the Soviet Bloc recast the European project and reopened the question of what Europe is. Alongside the formation of a European single market and currency union, the Eastern enlargement of the European Union and Turkey's quest for membership revived old debates about where Europe ends. Embattled debates over European identity dovetailed with discussions of Christian Europe and its Islamic other. Today, echoes of the EU’s self-image as a bastion of humanitarian reason and a beacon of democracy find their test in the refugee crisis. Stuck between seemingly perennial austerity and managed inhospitability, the EU’s “thin cosmopolitanism” appears all too content with integrating markets and merely fulfilling minimalist human rights norms. In a painful twist of irony, the only ones who still appear to take seriously the preamble of the failed European Constitution that described Europe as “a special area of human hope” are the refugees landing on Europe’s shores or, more often, drowning in the Mediterranean. While Europe’s politicians are working hard to discourage potential asylum seekers and appear determined to prove that Europe is not a special area of human hope, refugees are voting with their feet for a life in Europe.

Abstract: As the 20th century ended, a reappraisal began of the 1970s as a crucial turning point in modernity. For some historians the 1970s were marked as the moment “after the boom”. For others the epoch was defined by the shock of the global. For cultural historians it was an age of fragmentation. The 1970s were clearly an age of economic crisis, but this too could be understood in different ways. Deindustrialization and the end of Fordism were two options. Globalization another. The discovery of the limits to growth provided a resonant phrase to announce the environmental age. But, for economists and policy-makers, the 1970s stood for another type of epochal break, a revolution in monetary affairs. The end of Bretton Woods between 1971 and 1973 marked the universalization of fiat money. From the 1970s onwards, for the first time since the invention of money, nowhere, anywhere in the world was money directly anchored on gold. How would monetary systems be managed without this anchor? What would be tested in the 1970s and 1980s was a fundamental institutional question of the modern world: the relationship between capitalism, fiat money and democratic policy-making. If it is the double ending both of the postwar boom and the Great Inflation that defines our present, the history of anti-inflationism was never as simple as it appeared in narratives of a “great moderation” designed to legitimate currency policy.

Books

Recovering foundational ideas at the intersection of monetary rule and democratic politics, The Currency of Politics, examines six crucial episodes of monetary crisis, recovering the neglected political theories of money in the thought of such figures as Aristotle, John Locke, Johann Gottlieb Fichte, Karl Marx, and John Maynard Keynes. The book shows how these layers of crisis have come to define the way we look at money, and argues that informed public debate about money requires a better appreciation of the diverse political struggles over its meaning. Only through greater awareness of the historical limits of monetary politics can we begin to articulate more democratic conceptions of money.

The aim of this book is to understand the technological, legal and political impact of blockchain technology and its applications. The book mainly focuses on the challenges blockchain technology has so far faced in its first application in the areas of electronic money and finance, as well as those that it will inevitably face as its domain of application expands into other fields of economic activity such as smart contracts and initial coin offerings. The book provides an unparalleled critical analysis of the ambivalent potential of this technology for the economy and the legal system by contributing to current thinking on the role of law in shaping innovation.

Another Universalism provides both a wide-ranging and comprehensive engagement with Seyla Benhabib’s path-breaking interventions and a panoramic tour of the cutting edge of critical theory today. Contributors take part in key debates about the field’s past and future, tackling subjects such as the relationship between democracy and cosmopolitanism, the role of law in emancipatory struggles, human domination of nature, the deprovincialization of critical theory concerning questions of race and empire, as well as Hannah Arendt’s continuing significance. Covering a wide range of debates and themes, Another Universalism is united by a core question: How can universal norms of human freedom, equality, and dignity be reconciled with particular contexts, especially ones of exclusion, difference, and adversity? Searching for universalisms that emerge from the concrete struggles of emancipatory movements, this book points toward an expansive, inclusive, and radical democratic vision.

Interviews and Essays

Evgeny Morozov: “If you are looking for an excellent account of the many ways in which Friedrich Hayek shaped the thinking of some inside the broader crypto-money community, look no further than Stefan Eich's essay called “Old Utopias, New Tax Havens: The Politics of Bitcoin in Historical Perspective.” The piece did what many previous accounts of Bitcoin failed to do, namely to connect it, through first-rate intellectual history, to the broader neoliberal project that pushed for denationalizing money.”

A plea for moving beyond stale debates about the pros and cons of central bank independence as currently conceived in order to discuss more fundamental constitutional questions of how we can make central banks more democratic internally and at once more independent, by redefining independence as not against democracy but rather against the executive and financial markets.

Reviews

On Katrina Forrester’s In the Shadow of Justice, H-Diplo (January 2020).

Roundtable contribution on Katrina Forrester’s In the Shadow of Justice: Postwar Liberalism and the Remaking of Political Philosophy, H-Diplo, Roundtable Forum with an Introduction by Samuel Moyn (January 2020).

“Human Rights in Financial Times,” The Review of Politics, Vol. 81, Issue 2 (Spring 2019).

Combined review of Samuel Moyn, Not Enough: Human Rights in an Unequal World and David Kinley, Necessary Evil: How to Fix Finance by Saving Human Rights.

Translations and Other Work

I have translated several essays, lectures, and prize speeches by Seyla Benhabib into German. In 2012, I translated her Leopold Lucas Prize Lecture, which was published as Gleichheit und Differenz (Mohr Siebeck, 2013). An abbreviated version also appeared in Blätter für deutsche und internationale Politik.

In 2014, I translated her Meister Eckhart Prize Lecture, which was published in Kosmopolitismus ohne Illusionen: Menschenrechte in unruhigen Zeiten (Suhrkamp, 2016).

I assisted in a minor capacity in editing a collection of essays by the late Robert Wokler: Rousseau, the Age of Enlightenment, and their Legacies (Princeton University Press, 2012). The volume was edited by Bryan Garsten and includes an introduction by Christopher Brooke. (The amazing first chapter on "perfectible apes" is available here.)